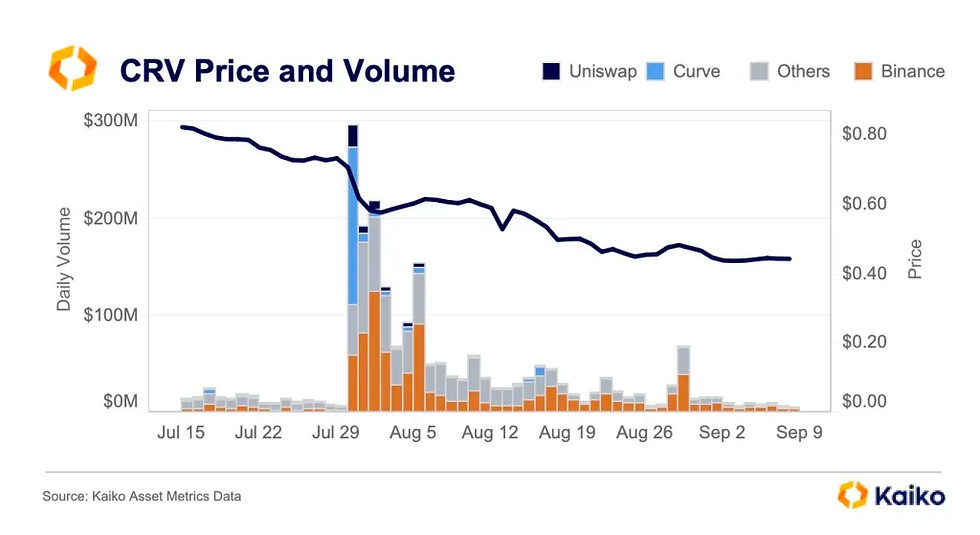

The trading volumes of CRV, the governance token of Curve, a decentralized exchange (DEX) for stablecoins, have plummeted by 97% in just two months since the hack that occurred in late July 2023. According to Kaiko, the trading volume of CRV on centralized exchanges, particularly on Binance where the token is actively traded, has dropped from approximately $300 million in late July to $7 million as of September 12.

CRV is available for trading on various centralized and decentralized exchanges such as Binance, Uniswap, and Curve, as indicated by trackers. However, Binance, being the world's most popular crypto exchange with high liquidity, has the highest volume of CRV trading, accounting for approximately 20% of the total trading volume. Bitbox is the next largest exchange with a market share of roughly 7%.

🌎《Now you can now start trading at TNNS PROX》📈

🔥Start trading today, click "sign up" from the link above.

CRV Trading Volume Drops 97% in 2 Months. Curve’s TVL, Price, And Trading Volumes Collapse

In the world of cryptocurrency, a decrease in trading volume usually suggests a decrease in interest in a particular digital asset or a sense of caution among investors. This can lead to a decline in the asset's liquidity as traders and investors withdraw, sometimes even selling off the coin as they seek stability and security. In some cases, they may take a wait-and-see approach, observing how the token responds to changing market conditions. CRV Trading Volume Drops 97% in 2 Months.

DeFiLlama reports that Curve's total value locked (TVL) currently stands at around $2.17 billion, a decrease from $3.25 billion following the protocol's hack. This drop in TVL and trading volumes is occurring during a general slowdown in the decentralized finance (DeFi) sector.

The decline in CRV's value and trading activity was exacerbated by the July breach, which resulted in the protocol losing assets worth more than $50 million. Although Curve managed to recover the majority of those funds, the incident raised concerns about the overall security of the platform.

The Hack And Erogov’s CRV Disposal

In the July hack, malicious actors took advantage of vulnerabilities in older versions of Vyper, a programming language used for creating smart contracts on the Ethereum platform, to exploit various Curve stablecoin pools. The automated nature of Curve's pools allowed the hackers to carry out a re-entrancy attack and drain multiple pools.

Following the hack, the price of CRV experienced a significant drop, plummeting from around $0.74 to $0.48 on July 30. Since then, it has continued to decline, reaching a new low for 2023 at $0.40.

Curve's CEO, Michael Egorov, was forced to sell his CRV holdings used to secure his loans on Aave and Frax Finance via over-the-counter (OTC) to entities and individuals such as Justin Sun when prices began to decline.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Comments